Employer Fica And Medicare Rates 2024-23

Employer Fica And Medicare Rates 2024-23. Employees, retirees not eligible for medicare, surviving dependents and cobra. Its use poses a unique issue for employers in terms of constructive receipt.

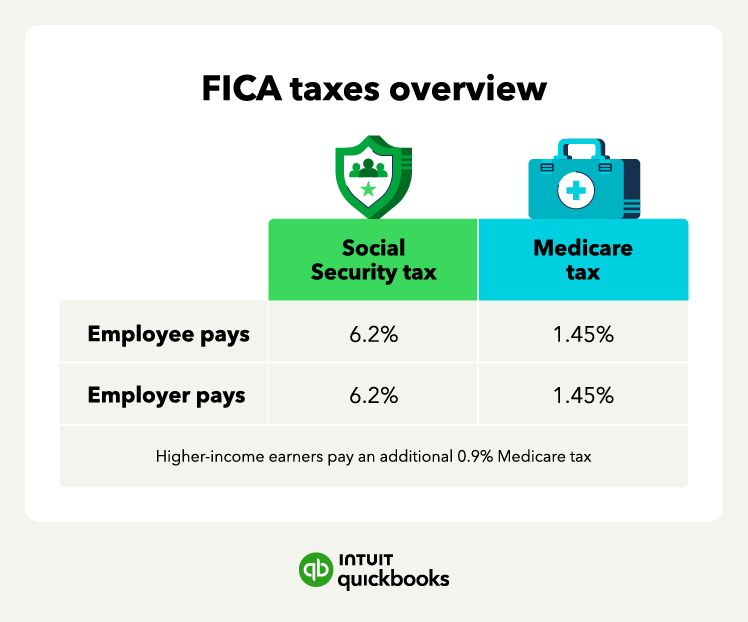

The maximum social security tax that employees and employers will each pay in 2024 is $10,453.20. But in the final rule, the agency reduced the cf further, by 3.37.

Employer Fica And Medicare Rates 2024-23 Images References :

Source: gabiyellissa.pages.dev

Source: gabiyellissa.pages.dev

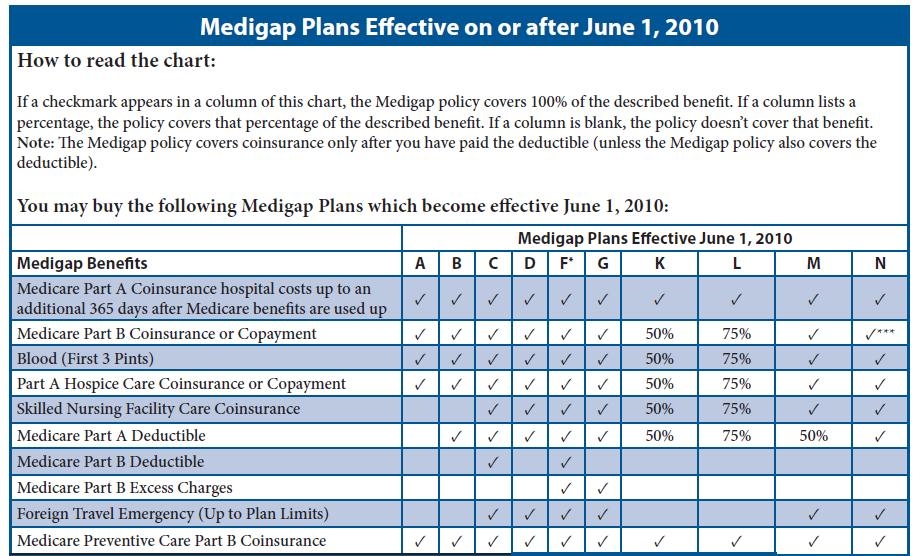

Employer Fica And Medicare Rates 2024 Chart Nelle Yalonda, Deduct and match any fica taxes to cover social security and medicare taxes:

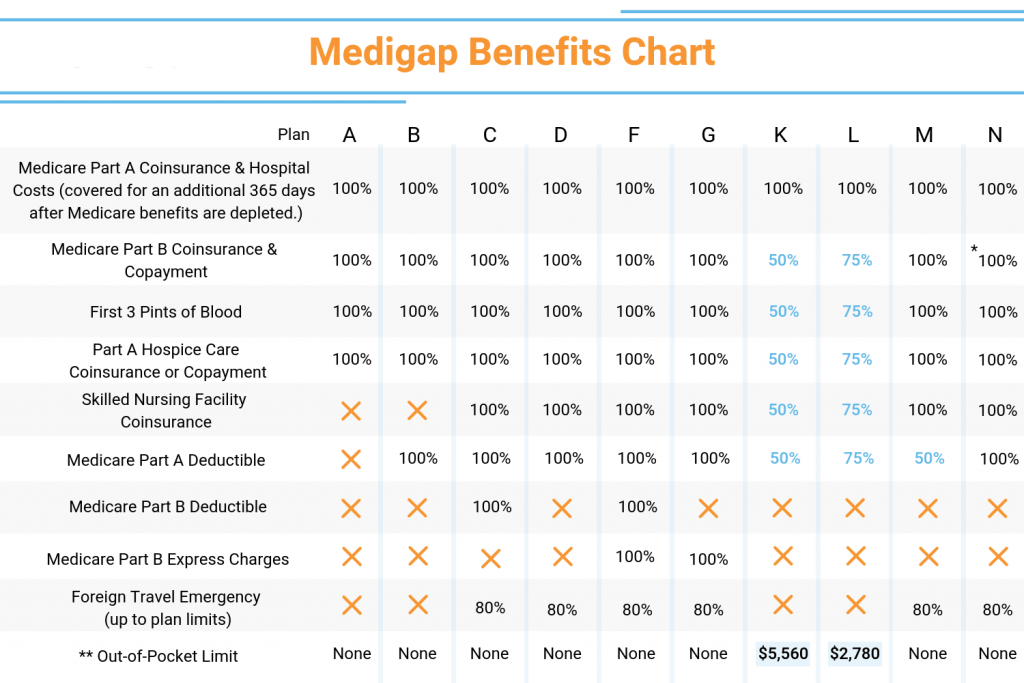

Fica And Medicare Rates 2024 Riva Verine, Rates for retirees who don’t get a 100%.

Source: beabannadiane.pages.dev

Source: beabannadiane.pages.dev

Employer Fica And Medicare Rates 2024 Lok Britt Colleen, For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Source: shayjacintha.pages.dev

Source: shayjacintha.pages.dev

Medicare Limits 2024 Chart Pdf Free Evita, The cost of medicare part a deductible, part b and part d are all rising.

Source: jenaqleandra.pages.dev

Source: jenaqleandra.pages.dev

Compare Medicare Plans And Options For 2024 And 2024 Sissy Ealasaid, Under current law, the tax rate will remain the same at the rate of 6.2% to be.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Fica And Medicare Tax Rates 2024 Adara, Today, the centers for medicare & medicaid services (cms) released the announcement of calendar year (cy) 2024 medicare advantage (ma) capitation rates and part c and.

Source: catemariam.pages.dev

Source: catemariam.pages.dev

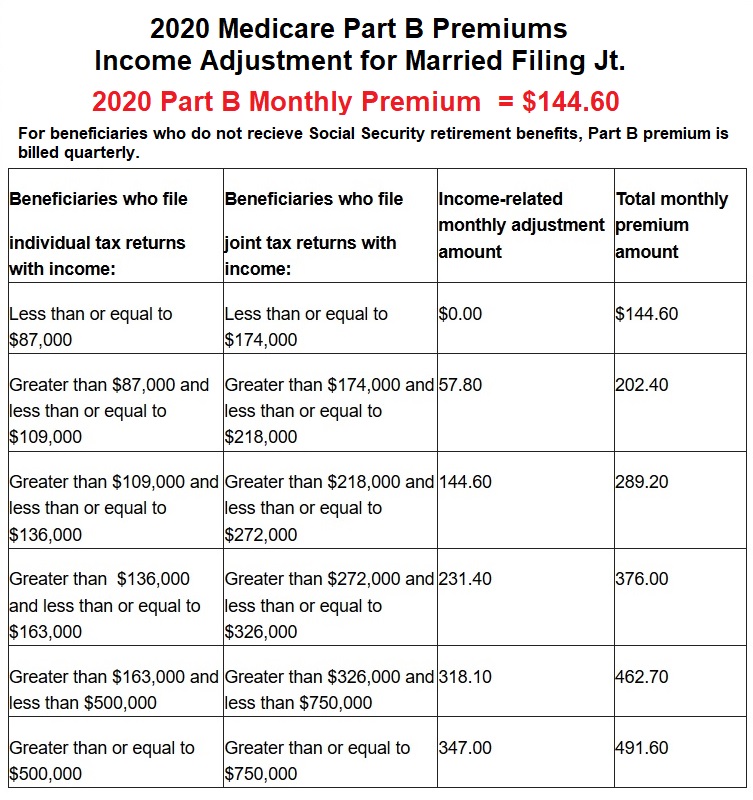

2024 Medicare Fee Schedule For 2024 Hmo Erinna Ladonna, The standard part b premium is now $174.70.

Source: kettiewperl.pages.dev

Source: kettiewperl.pages.dev

Expected Medicare Increase For 2024 Fran Malinde, You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is responsible for the other.

Source: corrybmarrilee.pages.dev

Source: corrybmarrilee.pages.dev

Medicare Limits 2024 Chart Zena Sarette, Then there’s medicare tax, which is 1.45% of each employee’s taxable wages until they have reached an annual earning of $200,000.

Source: marjayhollyanne.pages.dev

Source: marjayhollyanne.pages.dev

Tax Tables 2024 Ettie Concordia, The standard part b premium is now $174.70.